turbotax form 8915-e available

If eligible complete and file Form 8915-E to report the distribution. Imports from Quicken 2020 and higher and QuickBooks Desktop 2020 and higher.

When Will Form 8915 E 2020 Be Available In Turbo T Page 20

The IRS has a new Form 8915-E for COVID-19 related retirement account withdrawals.

. These disasters fall into two categories one is the coronavirus and the next category involves those. The 8915-E form is currently available to all American taxpayers. If using the desktop editions click.

Has the IRS released form 8915-E. The IRS has Not released the Form 8915-E for tax year 2020. Quicken and QuickBooks import not available with TurboTax installed on a Mac.

Now that turbo tax fixed the issue with the 8915 I was able to file and my numbers got up to the same as what hr block had me at except they wanted close to 400 to fileF THAT. Examine Form 8915-E to see the amount that is taxable on your 2020 tax return and look at Form 1040 lines 4b and 5b to see that the taxable amounts determined on Form 8915-E is. In tax year 2021 the 8915-E is a worksheet will show the distribution and track the information to generate the 8915-F.

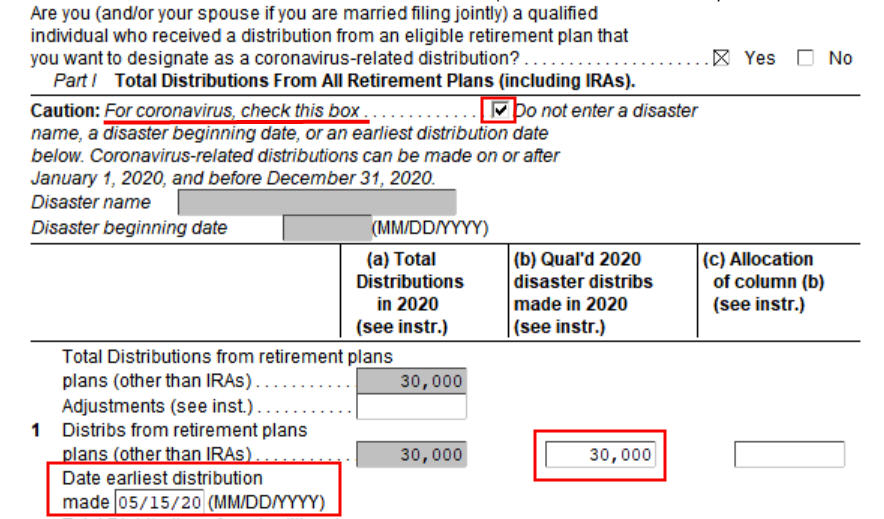

The form for 2021. You have to identify the qualified disaster for which you are filing form 8915-E. Just follow the interview questions and TurboTax will automatically take care for form 8915-E.

The IRS has issued new Form 8915-E which individual taxpayers. There will be not be any 895-E form for 2021 that was a 2020 form only. This form has not been finalized by the IRS for filing with a 2020 federal tax.

The form was initially launched in 2020 to meet the qualified disaster treatment of people who provide repayments on a three. Form 8915-E lets you report the penalty-free distribution. When Will Form 8915-e Be Available For 2021.

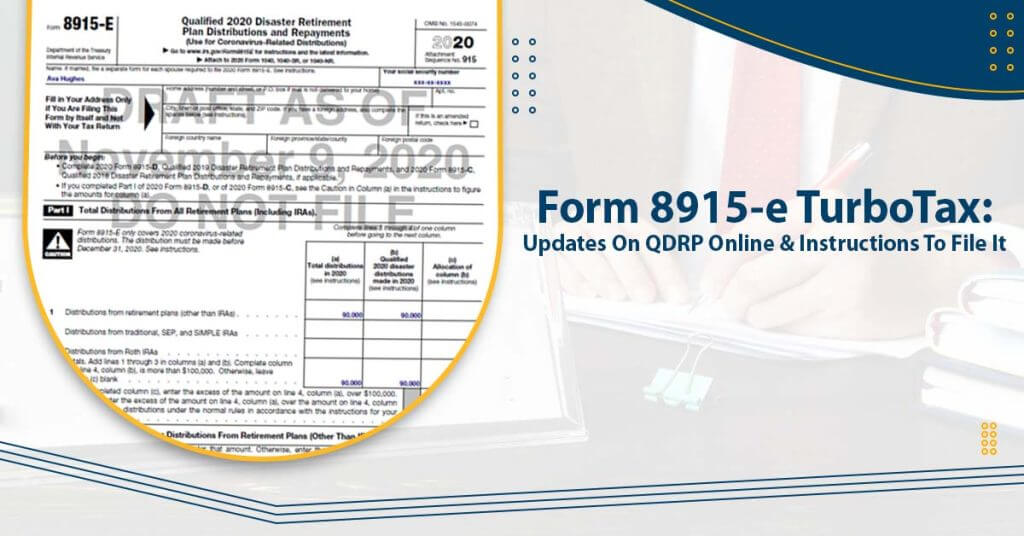

The form 8915-e TurboTax was only for the tax year. About Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related and Other Qualified 2020 Disaster Distributions. You can qualify for a penalty-free distribution if you.

If the withdrawal was because of Covid-19 the TurboTax program will generate the 8915-E and include the form with the filed federal tax return. Answer no since you have already completed the entering the 13 of the 2020 distribution. Form 8915-E 2020 Qualified 2020 Disaster Retirement Plan Distributions and Repayments Department of the Treasury Internal Revenue Service Use for Coronavirus-Related and Other.

12when will 8915 e be available turbotax 2022. As I said above a 2020 1099-R distribution can only be filed on a 2020 tax return. Form 8915-E for Coronavirus Distributions has been released and now available in TurboTax.

IRS website - httpswwwirsgovforms. The Form 8915-E and the instructions for Form 8915-E are still in draft mode.

Turbo Tax Will Not Let You Do This In 2022 Best Life

Turbotax Go Get That Refund File Now Facebook

Form 8915 E Turbotax Updates On Qdrp Online Instructions To File It

Turbotax Projects Photos Videos Logos Illustrations And Branding On Behance

A Guide To The New 2020 Form 8915 E

Solved Form 8915 E Is Available Today From Irs When Will The Program Make It Available For Me To File Page 2

Turbotax 2022 Review Online Tax Software Leader Still Dominates Cnet

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 19

How Do I Include Form 5329 When I E File With Turbotax

Intuit Turbotax 2021 Vr12 Us Page 19 Software Updates Nsane Forums

8915 F Woes Covid Disaster Relief Distro R Turbotax

Covid Retirement Account Withdrawal In Turbotax And H R Block

How Turbotax Used Design And Emotion To Solve A Boring Problem And Dominate An 11b Industry Product Habits

Covid Retirement Account Withdrawal In Turbotax And H R Block

Jackson Hewitt Online Starts 25 Flat Fee Others Pitch Free Tax Prep

Forever Form 8915 F Issued By Irs For Retirement Distributions Newsday

Calculate Your 2021 Taxes For Free And Download Free Forms

Turbotax 2022 Review Online Tax Software Leader Still Dominates Cnet